Here’s a stat that’ll blow your mind: Indonesia alone has more mobile gamers than the entire population of Germany. We’re talking 185 million people glued to their phones, grinding ranked matches on Mobile Legends while stuck in Jakarta traffic. But that’s just the tip of the iceberg. Southeast Asia has quietly become the world’s esports laboratory — a region where competitive gaming isn’t just entertainment, it’s a cultural phenomenon that’s rewriting the rules of sports, media, and youth culture.

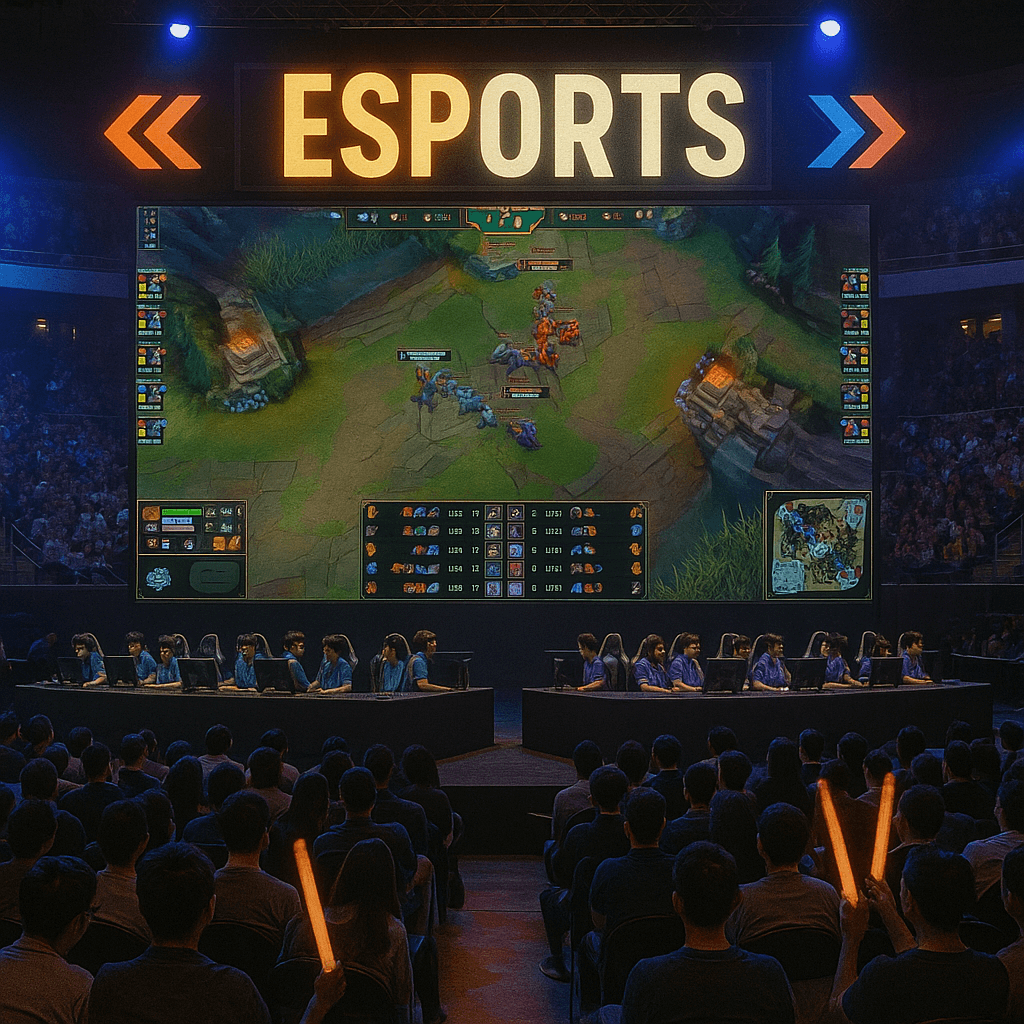

Ten years ago, esports in Southeast Asia meant cramped internet cafes filled with teenagers playing Dota on ancient PCs. Today? We’re looking at billion-dollar industries, government-backed professional leagues, and esports athletes earning more than traditional sports stars. The transformation hasn’t just been dramatic — it’s been revolutionary in ways that make Silicon Valley’s tech boom look quaint by comparison.

From internet cafes to billion-dollar industries — Southeast Asia’s esports revolution

The story of Southeast Asian esports begins in the most unlikely places: dingy internet cafes where the air conditioning barely worked and energy drink cans multiplied like bacteria. These weren’t glamorous venues — they were digital refuges where working-class kids could escape reality for a few dollars per hour.

But something magical happened in those sweaty rooms. While Western esports focused on individual PC gaming, Southeast Asia developed a communal gaming culture that emphasized teamwork, social interaction, and shared experiences. Friends would pool money to book adjacent computers. Strangers became teammates. Romance bloomed over late-night Dota sessions. This wasn’t just gaming — it was social infrastructure.

The transformation accelerated when smartphones became affordable around 2015. Suddenly, the barriers to competitive gaming collapsed. You didn’t need a $2,000 gaming rig or reliable internet — just a $200 phone and a data plan. Mobile Legends: Bang Bang launched in Southeast Asia in 2016 and within two years had 500 million registered users globally, with the vast majority concentrated in this region.

The infrastructure explosion

What happened next defied every prediction about emerging market technology adoption. Instead of slowly building traditional esports infrastructure, Southeast Asia leapfrogged directly to mobile-first competitive gaming ecosystems. Countries that struggled with basic internet connectivity suddenly had millions of people competing in professional-quality tournaments from their bedrooms.

Government recognition and investment

The most shocking development? Governments started treating esports like legitimate sports. The Philippines included esports in the 2019 Southeast Asian Games. Thailand launched a national esports strategy. Malaysia began issuing professional athlete visas for esports players. This wasn’t just recognition — it was institutional validation that elevated gaming from hobby to career path.

The generation gap collapse

Traditional Asian societies, known for respecting elders and established hierarchies, suddenly found teenagers earning more money than their parents through gaming skills. This role reversal created unprecedented cultural tension and acceptance simultaneously. Parents who once confiscated gaming devices began hiring coaches for their children.

Corporate invasion and legitimization

When Tencent, Garena, and other tech giants began investing billions in Southeast Asian esports infrastructure, the transformation accelerated beyond anyone’s imagination. Professional tournaments with production values rivaling traditional sports broadcasts. Training facilities that resembled tech campuses. Sponsorship deals that turned gamers into millionaires overnight.

Mobile gaming dominance — why Southeast Asia leads the global mobile esports explosion

While the rest of the world debated whether mobile games were “real” esports, Southeast Asia was already crowning mobile gaming champions and building entire industries around pocket-sized competition. The region’s mobile gaming revenue hit $8.8 billion in 2023, representing the fastest growth rate globally.

The mobile dominance wasn’t accidental — it was inevitable given regional realities. Internet infrastructure in many Southeast Asian countries couldn’t support consistent PC gaming, but mobile networks were robust enough for competitive play. Gaming PCs cost 3-6 months of average wages, while smartphones were accessible to middle-class families.

Mobile Legends became Southeast Asia’s national sport by accident. The game launched as a simplified version of League of Legends, designed for casual mobile play. Instead, it spawned professional leagues with prize pools exceeding $1 million and viewership numbers that embarrassed traditional sports broadcasts.

The technical innovation factor

Southeast Asian mobile esports pushed technological boundaries in unexpected ways. Players developed techniques that desktop gamers considered impossible: precise micro-movements using touchscreen controls, complex team coordination through mobile voice chat, and strategic depth that matched traditional PC MOBAs.

Cultural adaptation advantages

Mobile gaming fit Southeast Asian social patterns perfectly. Games could be played during commutes, lunch breaks, and family gatherings. Competitive play became integrated into daily life rather than requiring dedicated gaming sessions. This cultural compatibility accelerated adoption rates beyond what any market research predicted.

The streaming revolution

Facebook Gaming, YouTube Gaming, and regional platforms like Cube TV became massive entertainment networks centered around mobile esports content. Top streamers earned hundreds of thousands of dollars annually while broadcasting from their bedrooms using nothing more than smartphones and basic streaming software.

Grassroots tournament explosion

Mobile gaming’s low barrier to entry spawned thousands of amateur tournaments across the region. University competitions, corporate leagues, and neighborhood championships created pathways from casual play to professional careers. This grassroots ecosystem provided talent pipelines that traditional esports regions couldn’t match.

Cultural transformation — how esports changed Southeast Asian entertainment forever

Esports didn’t just add another entertainment option to Southeast Asian culture — it fundamentally altered how an entire generation consumes media, defines success, and structures social relationships. The impact extends far beyond gaming into fashion, music, language, and social hierarchies.

Traditional entertainment industries found themselves competing with teenagers broadcasting from their bedrooms. Television viewership among 18-34 demographics plummeted as esports streams attracted millions of concurrent viewers. Movie theaters struggled while esports tournaments sold out stadiums within minutes.

The linguistic impact alone tells an incredible story. Gaming terminology infiltrated everyday conversation across multiple languages. “GG” (good game) became standard farewell language. Strategic concepts from MOBAs entered business vocabulary. Parents learned gaming terms to communicate with their children.

- Celebrity culture redefinition: Traditional celebrities — movie stars, singers, athletes — suddenly competed for attention with esports players who commanded massive social media followings. Gaming personalities became brand ambassadors for products ranging from smartphones to fast food, earning endorsement deals that rivaled entertainment industry stars.

- Fashion and lifestyle integration: Esports merchandise became streetwear. Gaming chairs appeared in bedrooms as status symbols. Energy drink consumption patterns shifted based on professional player preferences. The aesthetic preferences of gaming culture influenced everything from interior design to smartphone accessories.

- Educational system disruption: Universities began offering esports scholarships. Parents who once viewed gaming as academic distraction started hiring professional coaches. Traditional career counseling expanded to include professional gaming pathways, forcing educational institutions to acknowledge non-traditional success models.

- Social hierarchy restructuring: Gaming skill became social currency among younger demographics. Traditional markers of status — academic achievement, family background, physical appearance — competed with competitive gaming rankings and streaming follower counts for social influence.

- Language evolution and creation: Each game spawned specialized vocabulary that transcended gaming contexts. Complex strategic concepts developed shorthand expressions that entered general usage. Multilingual gaming communities created hybrid languages that mixed English gaming terms with local languages.

The transformation affected family dynamics profoundly. Traditional Asian family structures, emphasizing respect for elders and established authority, adapted to accommodate children who possessed specialized knowledge and earning potential that parents couldn’t understand or replicate.

Religious and cultural institutions initially resisted gaming culture but eventually adapted. Buddhist temples began hosting gaming tournaments as community outreach. Islamic organizations developed guidelines for competitive gaming participation. Cultural festivals incorporated esports exhibitions and competitions.

Economic powerhouse — the financial ecosystem driving Southeast Asian esports growth

The numbers behind Southeast Asia’s esports explosion read like venture capital fever dreams. The region’s esports market grew from practically nothing in 2015 to $1.8 billion by 2023, with projections suggesting $3.5 billion by 2027. But raw revenue figures don’t capture the complexity of economic ecosystems that have emerged around competitive gaming.

Prize pools represent just the visible tip of a massive economic iceberg. The 2023 Mobile Legends World Championship offered $800,000 in prizes, but the total economic impact — including tourism, merchandise, broadcasting rights, and sponsorship activation — exceeded $50 million across host countries.

Sponsorship deals have evolved beyond traditional sports marketing into comprehensive lifestyle partnerships. Top Southeast Asian esports athletes sign contracts that include salary, performance bonuses, streaming revenue sharing, merchandise percentages, and appearance fees. The most successful players earn $500,000-$2 million annually, rivaling traditional sports athletes in smaller markets.

The streaming economy explosion

Content creation around esports generates massive economic activity that extends far beyond prize winnings. Popular streamers earn through multiple revenue streams: platform subscriptions, donation systems, merchandise sales, brand partnerships, and sponsored content. The top 100 Southeast Asian gaming content creators collectively earn an estimated $150 million annually.

Infrastructure investment boom

Esports facilities represent major capital investments across the region. Professional training facilities cost $2-5 million to construct and equip. Tournament venues require specialized technology installations worth millions more. This infrastructure spending creates construction jobs, ongoing maintenance positions, and specialized technical roles.

The talent development industry

Coaching, analysis, and player development have become legitimate professions. Professional esports organizations employ dozens of support staff: coaches, analysts, nutritionists, psychologists, and media specialists. This ecosystem creates middle-class employment opportunities in regions where such positions were previously scarce.

Regional economic integration

Esports tournaments drive significant tourism and cross-border economic activity. Major championships attract tens of thousands of international visitors, generating hotel bookings, restaurant revenue, and retail spending. The economic impact resembles traditional sporting events but with younger, more internationally mobile audiences.

Technology sector synergies

Esports growth has accelerated broader technology adoption and innovation. Improved internet infrastructure, mobile network upgrades, and streaming platform development create benefits that extend far beyond gaming applications. This technological advancement supports broader economic modernization efforts.

Educational and training market growth

The demand for esports education has created new market segments. Professional coaching services, strategy analysis tools, and skill development programs generate substantial revenue while creating employment for former professional players and gaming specialists.

Betting markets and esports — Southeast Asia’s gambling revolution meets competitive gaming

The convergence of Southeast Asia’s massive gambling culture with explosive esports growth has created betting markets that dwarf traditional sports wagering in some demographics. Esports betting volume in the region exceeds $2 billion annually, with mobile-friendly platforms making wagering as accessible as the games themselves.

Unlike traditional sports betting, which often requires specialized knowledge and significant time investment to understand, esports betting attracts participants who already possess deep game knowledge through personal play experience. This familiarity creates more sophisticated betting markets with tighter odds and more efficient pricing.

The integration isn’t just about betting on match outcomes. Modern esports wagering includes in-game events, player statistics, tournament progression, and even streaming-related propositions. Live betting during matches has become particularly popular, with odds shifting based on real-time game developments that experienced players can read and predict.

- Real-time betting advantages for experienced players: Gamers who understand game mechanics can identify betting opportunities that casual observers miss. A player’s item build choices, positioning patterns, or resource management decisions provide predictive information that translates into betting edges.

- Mobile platform integration creates seamless user experiences: Betting platforms designed specifically for mobile esports integrate directly with streaming platforms and game clients. Users can watch matches, analyze statistics, and place bets without switching applications, creating engagement levels that traditional sportsbooks struggle to match.

- Social betting and community wagering trends: Friend groups often organize private betting pools around esports matches, using social media platforms and messaging apps to coordinate wagers. This social component adds entertainment value beyond financial outcomes and increases overall market participation.

Regional regulations vary dramatically, creating complex legal landscapes that operators must navigate carefully. Some countries embrace esports betting as legitimate entertainment, while others struggle to adapt traditional gambling laws to digital competition formats.

The demographic profile of esports bettors differs significantly from traditional sports gambling. Younger, more tech-savvy, and internationally connected, these participants drive demand for innovative betting products and payment methods that traditional bookmakers weren’t equipped to provide.

Regional rivalries and global ambitions — where Southeast Asian esports heads next

Southeast Asia’s esports scene is approaching a crossroads where regional dominance meets global expansion ambitions. The question isn’t whether the region will remain relevant — it’s whether Southeast Asian esports organizations can translate regional success into worldwide influence.

The most intriguing development involves cross-pollination between Southeast Asian mobile gaming dominance and traditional PC esports markets. As mobile esports gain legitimacy globally, Southeast Asian teams and players possess systematic advantages built through years of mobile-first competitive experience.

Investment patterns suggest massive expansion plans. Tencent, Garena, and other major publishers are betting billions on Southeast Asian esports infrastructure development. New training facilities, broadcast studios, and tournament venues represent long-term commitments to regional growth rather than short-term profit extraction.

The talent pipeline continues expanding as educational institutions integrate esports programs and governments provide visa pathways for international players. This systematic approach to talent development could produce competitive advantages that persist for decades.

Cultural export potential remains largely untapped. Southeast Asian gaming communities have developed unique competitive formats, fan engagement methods, and content creation styles that could influence global esports development. The region’s mobile-first innovations may become standard practices worldwide as smartphone gaming technology advances.

The next five years will determine whether Southeast Asia becomes esports’ global hub or remains a large but regionally contained market. Early indicators suggest the former — investment levels, infrastructure development, and talent quality all point toward continued expansion and international influence.

But challenges remain significant. Internet infrastructure limitations persist in rural areas. Economic inequality affects access to competitive gaming opportunities. Political tensions between regional countries complicate tournament organization and player movement.

Will Southeast Asia’s esports revolution expand globally, or will it remain a fascinating regional phenomenon that transforms local culture while leaving international markets unchanged?

Title: Southeast Asia esports 🎮 Growth, culture & betting revolution

Description: Inside Southeast Asia’s esports explosion: mobile gaming dominance, cultural transformation, and betting markets 🚀 reshaping competitive gaming globally.